IMF's World Output Assessment & Federal Reserve Minutes

Often I see people reading only a limited number of news sources, I believe this behaviour is purposely driven by the very same news sources which they read. Not utilizing all possible sources of credible information would prove to be a limiting trading/investing strategy.

|

| Source: http://www.economist.com/news/world-week/21623792-business-week |

|

| Source: http://www.imf.org/external/pubs/ft/survey/so/2014/NEW100714A.htm |

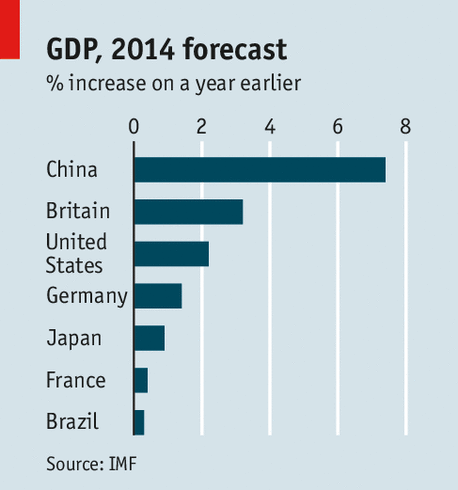

It is very useful to understand that, although both of the charts provide no false information, one chart will distort your trading/investing strategies more so than the second chart in the wrong direction.

This is because the second chart has a clearer perspective of reality simply by having more information.

The IMF's latest assessment of the world economy included negative changes for Brazil and Japan, some positive change from USA, and no changes to their prediction for China, who is the leader in GDP growth.

Federal Reserve Minutes Summary

-planned end to quantitative easing, a bond-buying program, after this month

-mandate is to keep economy growing without inflation

-labor conditions improved but no change in unemployment rate, also no sign of earnings increases (could be due to amply worker supply)

Federal Reserve Minutes Summary

-planned end to quantitative easing, a bond-buying program, after this month

-mandate is to keep economy growing without inflation

-labor conditions improved but no change in unemployment rate, also no sign of earnings increases (could be due to amply worker supply)

Some Worries: Housing recovery remained slow in all but few areas, despite extremely low mortgage rates, Slow Euro growth could mean a higher dollar as US exports become more expensive, Diminishing Government Spending was restraining economic growth (Fiscal Policy)

Comments

Post a Comment